In today’s fast-paced economy, relying on a single paycheck feels like putting all your eggs in one fragile basket. The idea of creating multiple streams of income has gained traction as a practical way to achieve financial stability and grow wealth over time. Whether you’re looking to pay off debt, save for a big goal, or simply gain more control over your financial future, diversifying your income sources can be a game-changer. This article dives deep into how to have multiple streams of income, offering actionable strategies, real-world examples, and expert insights to help you build a robust financial portfolio.

Why Multiple Income Streams Matter

The traditional model of working a 9-to-5 job and banking on a single salary is becoming less reliable. Layoffs, economic shifts, and unexpected life events can disrupt even the most stable careers. By creating multiple streams of income, you spread your financial risk and open doors to new opportunities. Think of it as building a safety net while also paving the way for wealth accumulation.

Multiple income streams don’t just provide security—they also offer flexibility. You can pursue passions, invest in personal growth, or even retire early if you play your cards right. According to a 2023 survey by the U.S. Census Bureau, nearly 20% of Americans now earn income from side hustles or secondary sources, a number that’s steadily climbing. This trend reflects a growing awareness that diversifying income is not just a luxury but a necessity in today’s world.

Understanding the Types of Income Streams

Before diving into how to create multiple income streams, it’s worth understanding the different types. Broadly, income streams fall into two categories: active and passive. Active income requires your direct time and effort, like a job or freelance work. Passive income, on the other hand, generates revenue with minimal ongoing effort, such as rental properties or dividends from investments. Here’s a breakdown of the main types:

- Earned Income: This comes from your primary job or side gigs, like consulting, freelancing, or part-time work.

- Investment Income: Earnings from stocks, bonds, mutual funds, or other financial instruments.

- Rental Income: Money earned from leasing out real estate, equipment, or even digital assets.

- Business Income: Profits from owning a business, whether it’s a small startup or an online store.

- Royalty Income: Payments from creative work, like books, music, or patented inventions.

- Passive Digital Income: Revenue from online ventures like affiliate marketing, e-books, or online courses.

Each type has its own risks and rewards, and the key is to find a mix that aligns with your skills, resources, and goals. Let’s explore how to build these streams step by step.

Read more: Side Hustle Success: How to Earn Extra Income While Working Full-Time

Step 1: Assess Your Skills and Resources

The first step to creating multiple income streams is to take stock of what you bring to the table. Your skills, experiences, and assets are the foundation for diversifying your income. Start by asking yourself:

- What skills do I have that others might pay for? Are you a great writer, a tech whiz, or a skilled photographer?

- What resources do I have access to? This could be anything from a spare room to rent out to a knack for social media.

- How much time can I realistically commit? Be honest about your availability to avoid overextending yourself.

For example, Sarah, a 35-year-old marketing manager, realized she could leverage her expertise in social media to offer consulting services to small businesses. She also had a passion for photography, which she turned into a weekend side hustle by shooting family portraits. By identifying her strengths, she created two additional income streams without leaving her day job.

Make a list of your skills and interests, and brainstorm how they could translate into income. Don’t underestimate seemingly small talents—everything from graphic design to teaching yoga can become a revenue source.

Step 2: Start with Low-Hanging Fruit

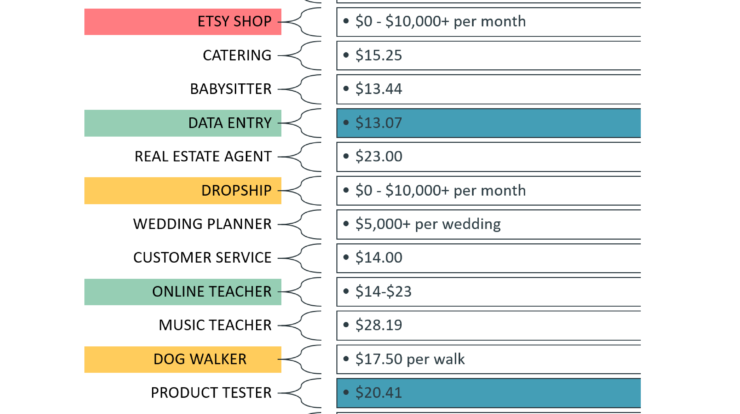

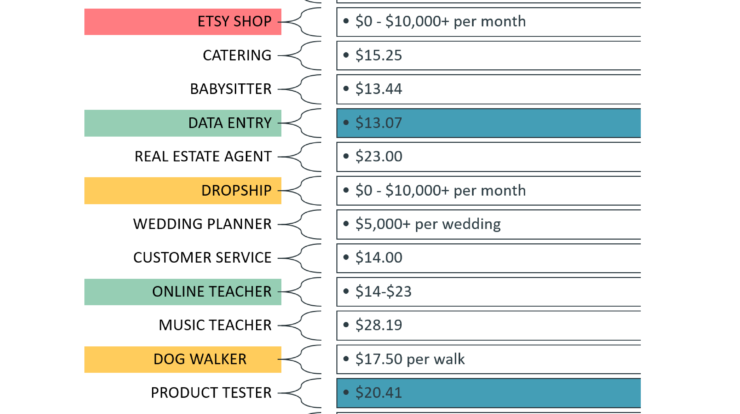

If you’re new to diversifying your income, start with something that requires minimal upfront investment. Side hustles are a great entry point because they often build on skills you already have. Here are a few ideas to consider:

- Freelancing: Platforms like Upwork and Fiverr make it easy to offer services like writing, graphic design, or virtual assistance. In 2024, the freelance economy contributed over $1.2 trillion to the U.S. economy, showing how viable this path is.

- Ridesharing or Delivery: If you have a car, driving for Uber or delivering for DoorDash can provide immediate cash flow.

- Tutoring or Teaching: Share your knowledge through platforms like Tutor.com or by offering local classes in subjects like math, music, or fitness.

Take the example of Mark, a high school teacher who started tutoring students online in the evenings. Within six months, he was earning an extra $1,000 a month, which he used to invest in a dividend-paying stock portfolio. The key is to start small, test the waters, and scale up as you gain confidence.

Read more: Online Money Making Opportunities – A Comprehensive Guide to Diverse Income Streams

Step 3: Invest in Passive Income Opportunities

Once you’ve established an active side hustle, consider adding passive income streams. These require more upfront effort or capital but can pay off significantly over time. Here are some proven options:

Real Estate Investments

Real estate remains one of the most reliable ways to generate passive income. You don’t need to buy a multi-family apartment complex to get started. Consider these approaches:

- Rental Properties: If you have the capital, purchasing a single-family home or condo to rent out can provide steady cash flow. Platforms like Airbnb also let you rent out a spare room or your entire home for short-term stays.

- Real Estate Investment Trusts (REITs): If buying property feels out of reach, REITs allow you to invest in real estate without owning physical properties. They’re traded like stocks and often pay healthy dividends.

For instance, Lisa, a 40-year-old nurse, used her savings to buy a small duplex. She lives in one unit and rents out the other, covering her mortgage and generating extra income. Over time, she plans to invest in more properties to build a larger portfolio.

Dividend Stocks

Investing in dividend-paying stocks is another way to create passive income. Companies like Procter & Gamble or Coca-Cola pay regular dividends, providing a steady stream of cash. Start small with a brokerage account and reinvest dividends to compound your earnings over time.

Online Ventures

The digital world offers endless opportunities for passive income. Consider:

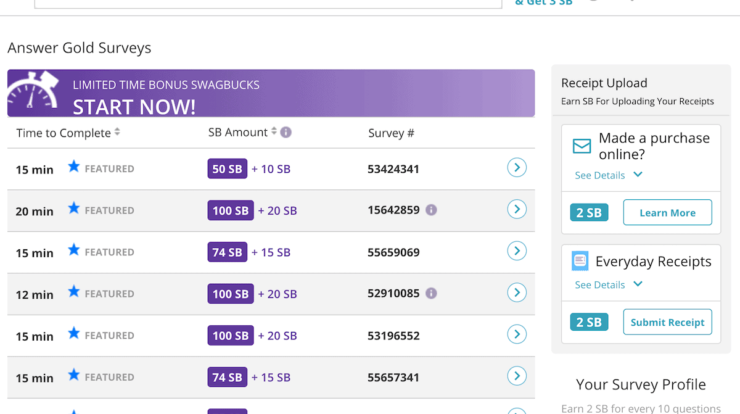

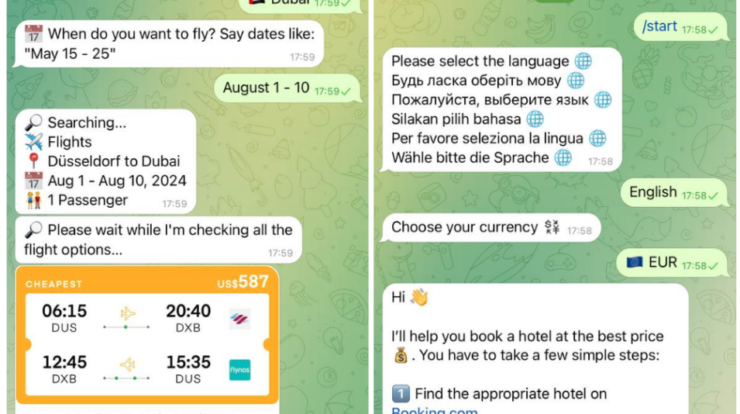

- Affiliate Marketing: Promote products on a blog, YouTube channel, or social media and earn a commission for each sale. For example, a blog about fitness could link to workout gear on Amazon’s affiliate program.

- Online Courses or E-books: If you’re an expert in a field, create a course on platforms like Udemy or sell an e-book on Gumroad. Once created, these can generate income for years with minimal upkeep.

Take the case of James, a software developer who created a $99 online course about coding for beginners. After an initial push to market it, he now earns $2,000 a month in passive income from course sales.

Step 4: Diversify Across Industries and Risk Levels

A common mistake is putting all your efforts into one type of income stream. To truly build wealth, diversify across industries and risk levels. For example, combining a stable side hustle (like freelancing) with a higher-risk investment (like stocks or cryptocurrency) balances potential rewards with security.

Consider this mix: a full-time job for stability, a side hustle for extra cash, a rental property for passive income, and a stock portfolio for long-term growth. This approach spreads risk and ensures that if one stream falters, others can pick up the slack.

Read more: RocketClips AI review – A Comprehensive Insight into AI-Driven Video Editing

Step 5: Automate and Delegate

As your income streams grow, managing them can become time-consuming. Automation and delegation are key to keeping things sustainable. Use tools like:

- Budgeting Apps: Apps like YNAB or Mint can help you track income from multiple sources and allocate funds wisely.

- Property Management Services: If you own rental properties, hiring a property manager can save time while ensuring your investment runs smoothly.

- Automated Investing: Platforms like Betterment or Wealthfront automate stock and bond investments, minimizing the need for constant monitoring.

For example, Emily, a small business owner, hired a virtual assistant to handle her freelance clients’ administrative tasks. This freed up her time to focus on scaling her e-commerce store, which now generates 40% of her total income.

Step 6: Stay Educated and Adapt

The economy and opportunities evolve, so staying informed is crucial. Read books like The Millionaire Next Door by Thomas J. Stanley or Rich Dad Poor Dad by Robert Kiyosaki for inspiration and practical advice. Follow financial blogs, listen to podcasts like The Dave Ramsey Show, or take online courses to deepen your knowledge.

Adapting to trends is equally important. For instance, the rise of remote work has made freelancing more accessible, while the gig economy has opened doors for quick side hustles. Keeping an eye on market trends can help you pivot to new opportunities as they arise.

Overcoming Common Challenges

Building multiple income streams isn’t without hurdles. Here are some common challenges and how to tackle them:

- Time Constraints: Start with low-effort side hustles and gradually transition to passive income as you free up time.

- Financial Risk: Research thoroughly before investing, and never put in more than you can afford to lose. Diversifying across income types mitigates risk.

- Burnout: Set boundaries to avoid overworking. For example, limit side hustle hours to weekends or a few evenings a week.

Real-World Success Stories

To illustrate the power of multiple income streams, consider these examples:

- Maria, a Graphic Designer: Maria started freelancing on Upwork, earning $500 a month. She used those earnings to invest in a REIT, which now pays $200 a month in dividends. She also runs a small Etsy shop selling digital art, adding another $300 monthly. Together, these streams cover her rent.

- David, a Corporate Analyst: David rents out a basement apartment on Airbnb, earning $1,200 a month. He also invests in dividend stocks, generating $400 quarterly. His side hustle as a financial coach brings in $800 a month, giving him the freedom to cut back on his corporate hours.

These stories show that you don’t need to be a millionaire to start. Small, consistent steps can lead to significant results.

Final Thoughts on Creating Multiple Income Streams

Building multiple streams of income is about taking control of your financial future. It’s not about getting rich quick—it’s about creating a sustainable, diversified portfolio that grows over time. Start by leveraging your skills, explore passive income opportunities, and stay adaptable to changing circumstances. With patience and persistence, you can build a financial foundation that offers both security and freedom.

The journey to multiple income streams is unique for everyone, but the principles remain the same: assess your strengths, start small, diversify, and keep learning. Whether you’re freelancing, investing, or launching a side business, each step brings you closer to financial independence. So, take that first step today—what’s one skill or resource you can turn into an income stream?